Getting the Most from Your Converters with A Process You Can Trust: The Platinum Group Metals (PGM) Market Watch

UCC Article Archives – May 15th, 2018 – Becky Berube

During the third week of May each year, stakeholders in the platinum industry gather in London, England for what is known as Platinum Week. Receptions, lectures, and forecasts abound.

At our company, we encourage recyclers to sell catalytic converters on assay; the analytic procedure that measures the content of precious metals in the catalytic converters. Take away the ambiguity of grading and sell the precious metals contained in your converters.

But what affects the price of the Platinum Group Metals(PGMs)? Three broad factors:

Macroeconomics

Precious metals are a safe-haven investment. When economic indicators are strong, precious metals are not the investment of choice. That means when the equities are booming, the dollar is strong, yields on 2 and 10-year US Treasury bonds are increasing, inflation is low, and unemployment is decreasing, precious metals are less attractive to investors.

When the equity market falters, the dollar weakens, Treasury yields decrease, interest rates rise, and unemployment fails to decrease, investors increase their appetite for precious metals as a hedge against a weakening economy.

Supply – Demand Fundamentals

Platinum demand has decreased with less use in auto catalyst loadings and the shrinking European diesel market. Japanese investors have bought less platinum and Chinese jewelry fabricators using less platinum in recent years. Mining supply is flat and there is a modest surplus of platinum in the market. The bright spot is the increase of physical demand for platinum in China as evidenced by increased imports, and the relationship of platinum to gold and the positive outlook for gold.

At the time of this writing, May 15, 2018, the platinum price is at its lowest level since mid-December with support at $900 and resistance at $950.

5 Year Platinum London Fix PM Daily with 60 and 200-day moving averages

The industrial demand and the supply – demand fundamentals remain strong for palladium as the demand for gasoline emission vehicles increases in Europe, light duty vehicle sales in China continue to rise, and palladium loadings in auto catalyst increases.

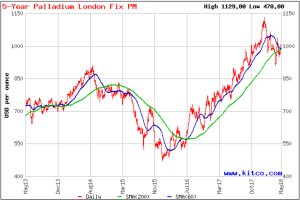

At the time of this writing, the palladium price is also down with support at $900 but resistance at $1,020.

5 Year Palladium London Fix PM Daily with 60 and 200-day moving averages

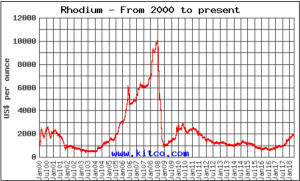

The minor metal contained in auto catalyst, Rhodium, is trading at a 7-year high at or above $2,000.

Geopolitical Factors

Since 80 percent of the world’s supply of platinum group metals comes from mining in South Africa and Russia, any disruption in the supply affects the price of the metals. A looming trade war, sanction concerns, adverse weather, energy outages, labor disputes that interrupt work and the supply will spike the price of these metals. When fears subside, investors will unwind or sell off their positions and the metal price can drop sharply as we have seen in recent weeks.

All of this to say, that even when the supply-demand fundamentals are strong, headlines still move markets. Countries coming together or warring impact investor sentiment and metal prices.

In converter recycling, the best recyclers are partnering with companies that educate. At our company, we believe selling on assay with refining terms is the best way to recycle scrap catalytic converters. Learning the way assay and refining works and how to avoid unethical trading practices takes time, but if done properly with a reliable recycling partner, yields much greater value.