Getting the Most from Your Converters with A Process You Can Trust: Keeping it Simple May Not Be So Easy with the Cats of the Future

UCC Article Archive – July 12th, 2018 – Becky Berube

Two years ago, we were part of an auto catalyst technology seminar, held in Atlanta, GA, with 104 delegates and where 18 presentations were given by industry leaders in the field of automotive exhaust catalyst. One of the greatest take-aways from that seminar was a presentation by Peter Duncan, General Manager of Market Research for Johnson Matthey, on the future complexities of auto cat systems and what it will mean for recycling.

What I want to share with you in this article, is an overview of how exhaust systems and converter loadings are changing. If you are selling by the piece, there is more room than ever for shades of gray when it comes to pricing. We encourage our customers to sell converters on assay, or the precious metal content within the converter, which eliminates the grading subjectivity.

Loadings and Trends

Basically, the tighter the emission standards, the higher the PGM (platinum group metal) loadings or cat value. The United States is predominantly gasoline engine vehicles; whereas, Europe is predominantly diesel engine vehicles. More than 90 percent of catalytic converter applications are made of a ceramic monolithic substrate, or honeycomb material; the remainder are metallic monolith substrates, commonly called foils or wires. The problem is no longer being able to identify and price ceramic and metallic converters, but rather something different.

Where the new recycling challenge emerges is the complexity of the exhaust system architectures for both gasoline and diesel engine vehicles. The new components may all look like cats, but they do not all have value; processing some of these components with others can even ruin a load.

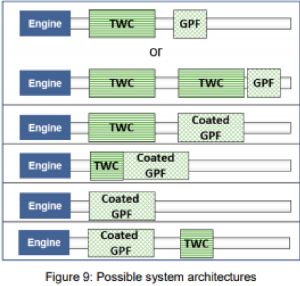

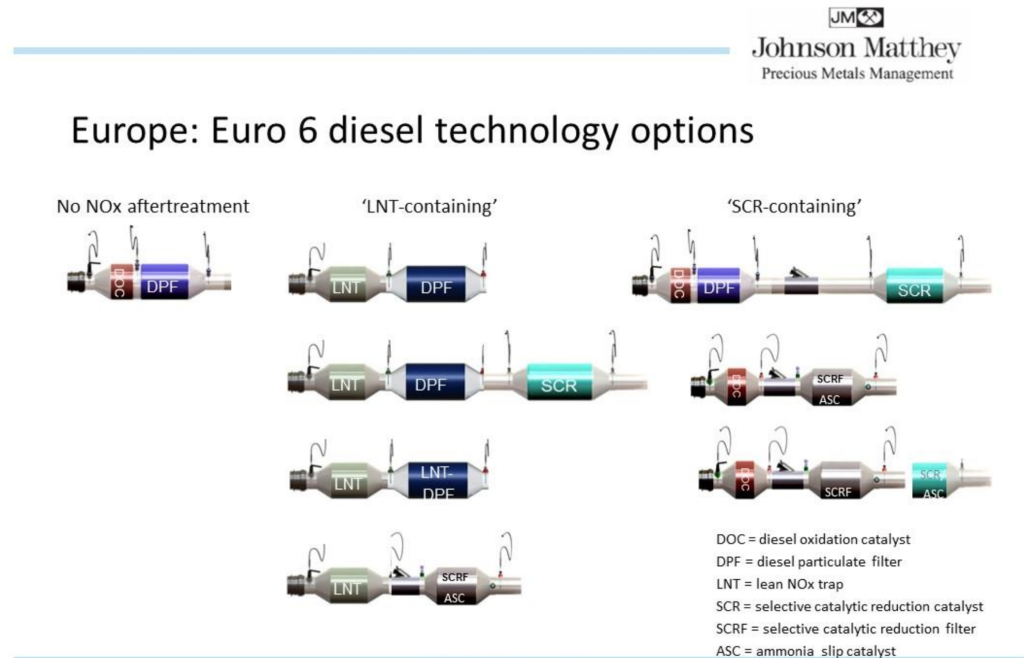

Gasoline engines emit lower soot than diesel engines under typical driving conditions. Most gasoline engine vehicles contain a combination of traditional ceramic three-way catalyst (TWC). However, gasoline particulate filters (GPFs) are being added to these systems. Diesel systems can have up to 4 components to handle emissions: the diesel oxidation catalyst (DOC), a diesel particulate filter (DPF), a lean NOx trap (LNT), and some type of selective catalytic reduction catalyst (SCR) or selective catalytic reduction filter (SCRF).

All the above-mentioned components, which resemble catalytic converters, have various amounts of PGMs, some, like SCRs and SCRFs are PGM-free. See the diagrams below.

Diagram courtesy of: The Association for Emissions Control by Catalyst (https://www.aecc.eu/wp-content/uploads/2017/11/2017-AECC-technical-summary-on-GPF-final.pdf)

Shown here as well.

Diagram courtesy of Peter Duncan, General Manager, Market Research, of Johnson Matthey, IPMI 2016

In terms of PGM loadings, the DOCs, diesel oxidation catalysts are like regular gasoline catalysts, having even higher loadings. DPFs, diesel particulate filters, have some value, generally low. DPFs can have one of two bases: aluminum titanate (ATI) or silicon carbide (SiC). Silicon carbide-based DPFs must be processed separately at higher temperatures with oxidation to avoid combustion. This represents higher recycling costs and when comingled can lead to lower metal yields. SCRs and SCRFs, selective catalytic reduction catalysts and filters are PGM free, having zero value. LNTs, Lean NOx traps have some value, albeit low.

Whether you are buying or selling converters by the piece, these complex exhaust system architectures are beginning to pose a problem in identifying, grading, and pricing. This to say, buyer and seller beware.

Future Powertrains and PGMs

You may be wondering about future powertrains and how they may affect the demand and use of PGMs. In general, these powertrains are unlikely to completely replace the internal combustion engine (ICE) market but will for the most part contain similar or higher PGM loadings. Gasoline turbo direct injection (GTDI) engines have better fuel efficiency but higher hydrocarbon and particulate emissions; these will result in higher PGM use. Lean burn gasoline (LBG)engines also have better fuel efficiency but higher NOx emissions requiring LNTs and thus more PGM use. Battery electric vehicles (BEV) require no PGMs. Hybrid electric vehicles (HEV) with their “cold start” will require 10-15% more PGMs. Finally, fuel cell electric vehicles (FCEV) which are platinum heavy will also increase PGM use.

Many people ask us, what will we do when catalytic converters are no longer circulating in the market? Our thought, based on market research, is that alternative powertrains are unlikely to replace the internal combustion engine any time soon. And, even if they did, we will just recycle the PGM-bearing components in the new powertrains.

In converter recycling, the best recyclers are partnering with companies that educate. At our company, we believe selling on assay with refining terms is the best way to recycle scrap catalytic converters. Learning the way assay and refining works and how to avoid unethical trading practices takes time, but if done properly with a reliable recycling partner, yields much greater value.