UCC Article Archive – January 18th, 2018 – Becky Berube

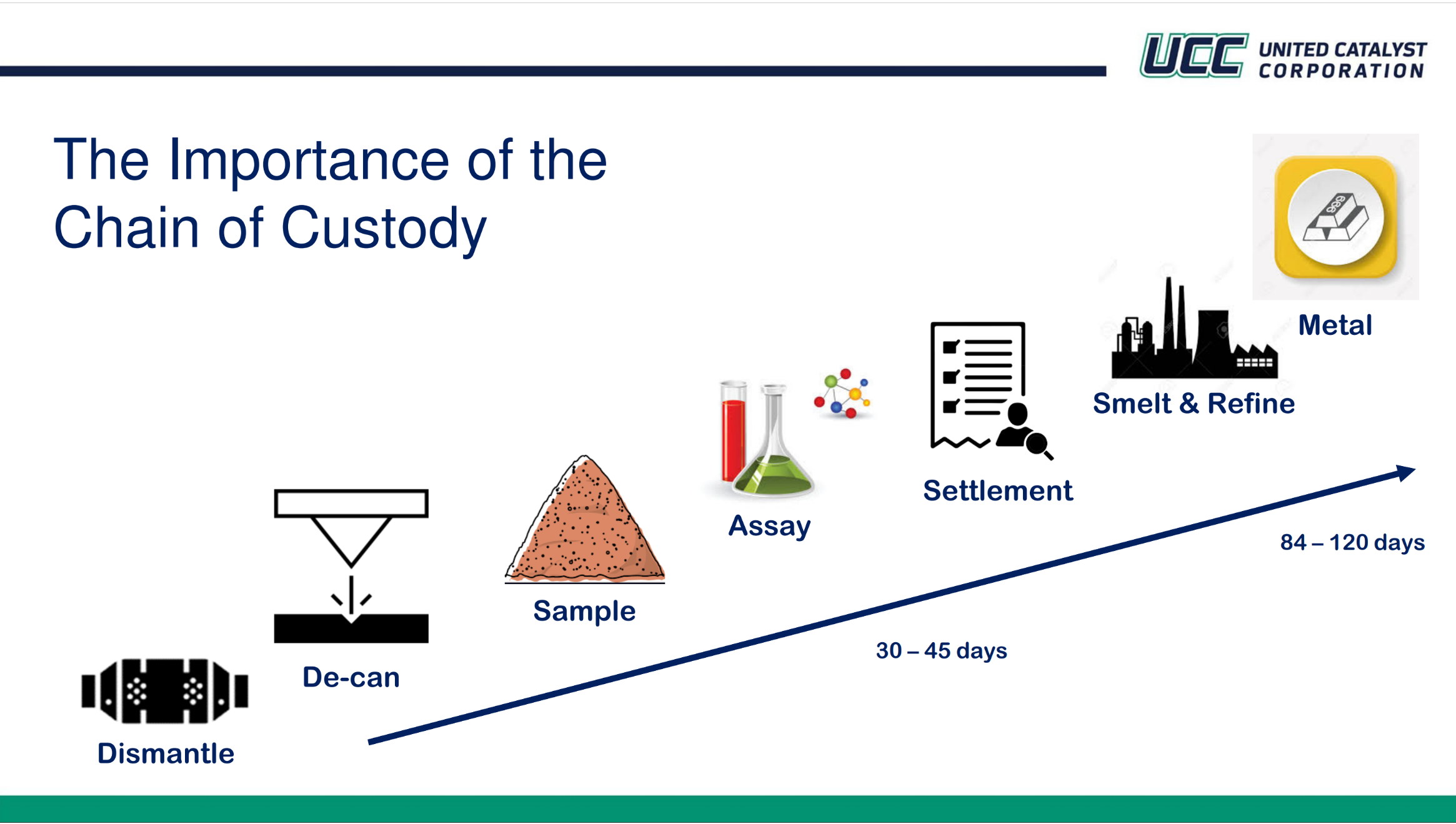

In converter recycling, the best recyclers know their numbers and partner with companies that educate. Knowing key metrics about your converter loads safeguards you against misleading key metrics, like your average price per unit, and increases your bottom line.

Every recycler looks at his or her average converter price. It’s an easy metric to track but an even easier number to get wrong if you didn’t get an accurate whole-body count before you shipped. You would be surprised how many recyclers consider the average sales price as gospel, but do not take the time to count their load before selling it. Relying on your processor to count for you, could be costing you.

Let’s look at an example.

If a Gaylord box holds approximately 100 converters and the average price per unit is $75, the box would be worth $7,500.

If your dismantler can only fit 80 converters in the box, due to pipes or the size of the box, and you get paid $7,500, your true average is $93.75.

If your dismantler can fit 120 converters in the box, and you get paid $7,500, your true average is $62.50.

The truth is, if you don’t count the units before you sell, or if you rely on your buyer or processor to count for you, then you really don’t know your true average.

This is a simple example.

The problem of determining your average price per unit is compounded by empty and metallic (foil/wire) converters that change your count and the way your average is calculated.

Take our example above.

If you have a box of 100 converters, and I report to you 80 ceramic converters, 15 empties, and 5 metallic converters, and pay you $7,500, I will lead you to believe your average for the 80 ceramic units is $93.75.

However, if all 100 are full converters, and I pay you $7,500, then your true average is still $75 per unit, but I led you to believe it was $93.75.

The point is, if you don’t count the units, including empties and metallic converters, you don’t really know what you have in inventory and your average is whatever we tell you it is. Educated recyclers know how important the count is to tracking profits.

The average unit price is just one of many key metrics when it comes to converter recycling. There are many more. Each key metric effects your profits and how you view and choose your processing company. Unfortunately, it is very easy to be misled in converter recycling.

To avoid common pitfalls in converter recycling, we suggest the following actions.

Know your count before you sell. Train a key person to count and inspect the converters before you package them up. Teach him or her the difference between the ceramic and metallic (foil/wire) converters. And if you are selling on assay recovery, send in the empties if they have just a little catalyst in them. A good processor will cut those and add that material. Also, if it’s genuinely empty, you and the processor will both agree that it is.

Become an educated seller. Work with a company that believes in educating you about your loads. A good company will not hesitate to explain your invoice and how the numbers are derived. With selling on assay recovery, your results can be verified. That’s the beauty of the program. However, as with all science and commodity sales, we are taking something complex and simplifying it for ease. This lack of uniformity across companies that process and refine, makes you an easy target for skimming weight, actual value, and YOUR profits.

Audit your program. Become a data junkie. Learn all the key metrics to avoid misleading data, like your average converter price, and track true sales. You will be amazed as you gain data points, how easy it is to get misled.

When you look at a box of converters that are ready to be sold, ask yourself whether each converter worth $75 or $93.75? Multiply this by the number of converters you are shipping, and you will see the importance of knowing before you ship. If you’re going to live by that average price per unit, you don’t want to leave that number up to someone else’s discretion.

At United Catalyst Corporation, we educate recyclers every day. Stephen R. Covey once said,

“If the ladder is not leaning against the right wall, every step we take just gets us to the wrong place faster.” We believe data doesn’t lie IF you know how to it was derived and how to interpret it.